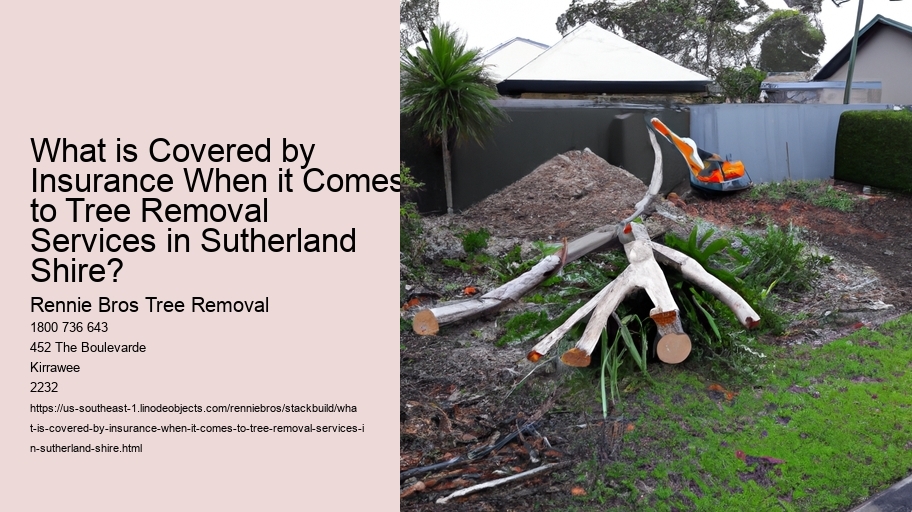

Types of Tree Removal Situations Covered by Insurance

When it comes to tree removal services in Sutherland Shire, many folks wonder what types of situations are covered by insurance. What is Stump Grinding, and Why Is It Important After Tree Removal in Sutherland Shire? . It's not always a straightforward answer (unfortunately), but let's try to unravel this complex topic.

First off, it's important to understand that insurance doesn't cover every tree removal scenario. Most insurance policies are designed to protect homeowners from unexpected and sudden events, not from regular maintenance. For instance, if a tree falls on your house during a storm, causing damage, your insurance is likely to cover the removal of that tree. However, if a tree is simply old and needs to be removed, don't expect the insurance to cover it.

Now, let's talk about storm damage. When a tree is brought down by high winds or heavy rain, and it hits a structure on your property (like your house, garage, or even a fence), insurance usually steps in. The cost of removing the tree and repairing the damage is typically covered. But here's the kicker – if the tree falls and causes no damage to a structure, insurance companies often won't pay for its removal. It sounds a bit unfair, right?

Another situation where insurance might help is when a tree falls and blocks your driveway, preventing access to your home. Some policies cover tree removal in this case, although it can depend on the specific terms and conditions of your policy. It's always a good idea to check with your insurance provider to understand what exactly is covered.

In cases of fire, if a tree catches alight and damages your property, insurance is likely to cover the removal of the tree and any repairs needed. But, if the tree is simply scorched and poses no immediate risk, you might find yourself footing the bill for its removal. Oh, how frustrating!

Insurance doesn't usually cover tree removal for preventative measures. If a tree is leaning dangerously but hasn't fallen yet, you might be advised to remove it to prevent potential damage. Unfortunately, this proactive approach usually isn't covered by insurance, leaving homeowners to deal with the costs themselves.

In conclusion, while insurance can be a lifesaver in certain tree removal situations, it's not a catch-all solution. It's crucial to read the fine print of your policy and perhaps even have a chat with your provider to clarify what's covered and what's not. After all, nobody wants to be caught off guard when a tree decides to make an unwanted visit!

Factors Affecting Insurance Coverage for Tree Removal

When it comes to insurance coverage for tree removal services in Sutherland Shire, it ain't as straightforward as one might hope. There are several factors that can affect whether or not your insurance will foot the bill for removing a tree. First and foremost, it's crucial to understand that insurance policies generally don't cover tree removal unless the tree falls due to specific events like storms or wind damage. If a tree's fallen because of neglect or disease, well, you're probably outta luck!

One key factor affecting coverage is the cause of the tree's fall. Insurance companies typically cover tree removal if the tree has fallen on an insured structure, such as your house or garage, due to a covered peril like a storm. However, if the tree just toppled over due to rot or a lack of maintenance, most policies won't cover it. This distinction is critical because it determines whether you'll have financial assistance or not.

Location also plays a role in insurance coverage (believe it or not). If the fallen tree is blocking your driveway or street access, some policies might provide coverage for removal, even if it hasn't damaged a structure. But if the tree lands harmlessly in the yard, well, you might have to handle that on your own dime!

Another factor is the type of insurance policy you have. Homeowners insurance often includes some coverage for tree removal, but the specifics can vary widely. It's essential to review your policy details (as tedious as that sounds) to understand what's covered. Some policies might offer limited coverage, capping the amount they'll pay for tree removal, which can be a nasty surprise if you weren't expecting it.

Additionally, the size of the tree and the complexity of the removal process can influence coverage. Larger trees or those in precarious positions might require specialized services, and not all insurance policies will cover the full cost of these more complex removals. So, it's a good idea to check with your insurer about any limitations on coverage amounts.

In conclusion, while tree removal services can be costly, insurance doesn't always provide the safety net we hope for. Factors like the cause of the tree's fall, its location, and the specifics of your insurance policy all play a part in determining coverage. So, before assuming that insurance will take care of it, take a moment to review your policy and maybe even have a chat with your insurance provider. After all, it's better to be safe than sorry!

Common Exclusions in Tree Removal Insurance Policies

When discussing tree removal insurance policies in Sutherland Shire, it's important to understand not only what's covered, but also what's not. Common exclusions can really catch folks off guard if they're not paying attention. So, let's dive into some of these exclusions, shall we?

First and foremost, most insurance policies won't cover tree removal if the tree was already dead or dying before the insurance policy started. It's like trying to buy car insurance after you've already had an accident-it's just not gonna happen. Insurance companies aren't in the business of covering pre-existing conditions, whether it's a sick tree or a busted fender.

Additionally, damages caused by negligence are often excluded. If you've been warned that a tree on your property is a hazard but you decide to ignore it, the insurance provider might not be too sympathetic. Let's say a massive storm rolls through and that neglected tree causes damage; you might find yourself footing the bill. Yikes!

Wear and tear is another common exclusion. Trees that naturally fall due to old age or decay (without any external force like a storm) generally aren't covered. It's like when your roof starts leaking because it's 30 years old-you probably can't claim that on your home insurance either. It's a bummer, but that's how it goes.

Homeowner's tree removal insurance also often excludes damage caused by certain natural disasters. Earthquakes, for example, might not be covered unless you've got a specific add-on to your policy. So, if you're living in an area that's prone to shaking ground, it could be wise to check your policy closely.

Moreover, if your tree falls but doesn't cause any damage to a structure or block any access, you might be surprised to learn that removal won't be covered by insurance. If the tree's just chilling in your garden and not hurting anyone or anything, the cost to remove it usually comes out of your pocket. info tree Doesn't seem fair, does it?

In conclusion, while tree removal insurance can be quite helpful, it's crucial to know its limitations. Those exclusions are there, and they can be a real pain if you're not prepared. Always read the fine print (I know, it's boring but necessary) and consider talking to your insurance provider to clarify any doubts. After all, nobody likes surprises, especially when they involve unexpected expenses!

Process of Filing an Insurance Claim for Tree Removal

Ah, the process of filing an insurance claim for tree removal in Sutherland Shire-it's not as straightforward as one might think! When it comes to what insurance covers for tree removal services, you'll find that there are quite a few nuances involved. So, you're dealing with a fallen tree and wondering, "Is this covered by my insurance?" Well, don't assume it's a simple yes or no answer.

First off, let's talk about the policy itself. Most homeowners' insurance policies will cover tree removal if the tree falls due to a storm or some other 'insured peril' like fire or vandalism (yes, trees can get vandalized too!). However, if the tree simply falls due to neglect or lack of maintenance, you're probably not going to be covered. Insurers are usually not keen on footing the bill for something that could've been prevented with a little TLC.

Now, when you do file a claim, make sure you have all your ducks in a row. You'll need to document everything. Take photos of the fallen tree, any damage it caused, and even the area around it. Why? Because insurers love evidence. It's like their bread and butter. Without solid proof, your claim might be tossed out quicker than yesterday's news.

And don't forget, the cost of removing a tree that hasn't caused any damage might not be covered at all. Yep, you heard that right! If a tree falls in your yard and doesn't hurt a thing, your insurance might say, "Well, that's your problem." It's not the most comforting thought, but it's the reality for many policies out there.

When you finally submit the claim, brace yourself for what could be a bit of a wait. These things don't resolve themselves overnight, you know. The insurance company will want to send out an adjuster to assess the damage and the situation. It's all part of their process. Be patient, and keep your fingers crossed for a favorable outcome.

Oh, and a little tip-check your policy thoroughly and maybe even talk to your insurer before you have to deal with a fallen tree. Knowing what's covered and what's not can save you a lot of grief down the line. In the world of insurance, surprises are rarely a good thing.

So there you have it! The process of filing a claim for tree removal in Sutherland Shire involves a bit of legwork, a dash of patience, and a whole lot of documentation. But hey, if you play your cards right, you might just come out on top.

Tips for Ensuring Adequate Tree Removal Coverage

When it comes to tree removal services in Sutherland Shire, understanding what insurance covers can be a bit tricky. It's essential to ensure you're adequately covered (so you don't have any nasty surprises). First off, not all insurance policies are created equal. So, let's dive into some tips for ensuring adequate tree removal coverage!

Firstly, you should definitely review your current insurance policy. Many folks assume that their home insurance covers all tree-related incidents, but that's not always the case. It's crucial to check if your policy explicitly mentions tree removal. If it doesn't, you might wanna talk to your insurance provider about adding that coverage. Not having it could cost you a lot more in the long run.

Next, consider the specifics of what's covered. Insurance might cover tree removal if the tree's fallen due to a storm or other natural causes. However, it often won't cover removal for trees that are simply old or diseased. Oh, and here's something else to keep in mind: the location of the tree can matter!

What is Covered by Insurance When it Comes to Tree Removal Services in Sutherland Shire? - tree lopping

- shrubs

- info tree

- tree lopping

Another tip is to document everything. If a tree falls and causes damage, take photos immediately. This documentation can be invaluable when you're filing a claim. The insurance company might not believe you if you just give 'em a call without any evidence.

Also, it's a good idea to have a chat with a professional tree removal service. They often know the ins and outs of insurance claims and can offer advice on ensuring your coverage is adequate. tree lopping Plus, they can give you an estimate, which your insurance company might require.

Lastly, don't forget to ask about additional living expenses. If a tree causes significant damage to your home, you might need to live elsewhere temporarily. Some insurance policies cover these costs, but not all do, so it's worth checking.

In conclusion, ensuring adequate tree removal coverage involves understanding your current policy, knowing what's actually covered, documenting incidents, consulting with professionals, and considering additional living expenses. Don't assume you're covered for everything; take the time to verify and adjust your policy if necessary. After all, it's better to be safe than sorry, right?

Role of Professional Tree Removal Services in Insurance Claims

Navigating the intricacies of insurance claims related to tree removal services in Sutherland Shire can be quite a tangled affair. When it comes to understanding what's covered by insurance in this context, the role of professional tree removal services becomes increasingly significant. Not everyone realizes how vital these services are until they face the daunting aftermath of a storm or unexpected tree fall.

Let's be honest, nobody wants to deal with the mess and potential damage a fallen tree can cause. But when it happens, one might wonder, is this covered by my insurance policy? Typically, insurance policies cover tree removal if the tree has caused damage to a structure that's insured (like your home or a shed). However, if a tree simply falls in your yard without hitting anything important, don't expect your insurance to step in. It's not that straightforward, is it?

Professional tree removal services play a crucial role in these scenarios. They provide detailed assessments of the damage, which can be essential for insurance claims. When filing a claim, insurers often require evidence of the damage and documentation from a qualified service provider. This is where professional tree removal services come in handy! They can offer comprehensive reports and even photographs to support your claim. Without these professionals, substantiating the extent of damage to your insurer could be quite challenging.

Moreover, hiring a professional ensures that the job is done safely and efficiently. Imagine trying to remove a massive tree on your own, risking further damage to your property or even injury. It's not just about removing the tree; it's about doing it right. Insurers may deny claims if the tree removal was done improperly or if it caused additional damage. Therefore, it's crucial to rely on experts who know the ropes.

In Sutherland Shire, as in many places, understanding the specifics of your insurance policy is key. Some policies might offer debris removal as an additional benefit, but not all do. So, it's essential to read the fine print and (most importantly) ask questions if you're unsure about what's included in your coverage. Don't assume everything's covered just because you pay your premiums.

In conclusion, while insurance may cover certain aspects of tree removal, it doesn't cover everything. Professional tree removal services provide invaluable assistance not only in executing the removal but also in facilitating insurance claims. They help ensure that all necessary documentation is in order, making a potentially stressful situation a bit more manageable. So, next time a tree unexpectedly interrupts your peaceful day, remember that professionals can make all the difference in the world!