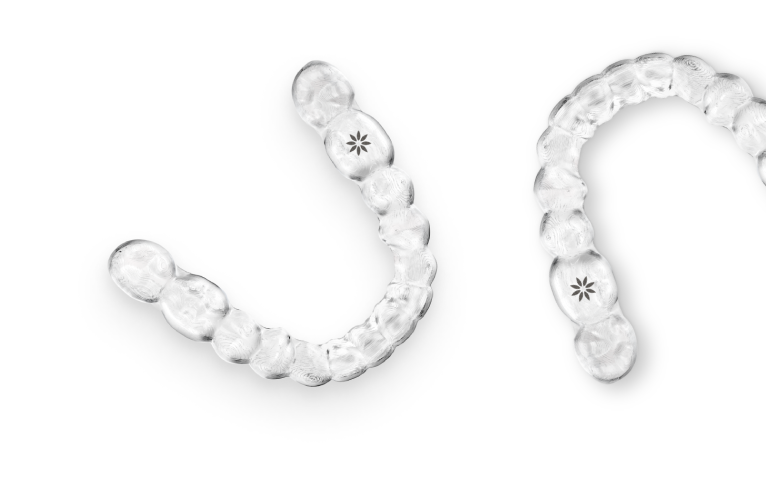

clear path aligners

FSA's are developed by employers, via work-provided health insurance. Individuals that are freelance or do not have medical insurance with their tasks are not eligible.

How an FSA functions:.

Employee accepts a salary reduction at the beginning of the year-- Make certain the amount matches an annual estimate of clinical costs, as any kind of unused cash is forfeited at the end of the year.

Companies contribute a section of your pre-tax income-- Contributions are distributed quarterly, up to a maximum quantity of $2,750 annually. Some companies might add their own contributions.

Send compensation insurance claim to the FSA-- To access the money, you must use through your company. After offering evidence of medical costs and a declaration from your insurance coverage verifying treatment is not covered, you will certainly be compensated the sum total, tax-free.

Wellness Interest-bearing Accounts (HSA).

A Wellness Savings Account is a tax-free savings account to aid to cover health-related expenses. Unlike an FSA, if your company does not use an HSA, you can establish it up as an individual. Qualification requirements are set by the Irs (IRS):.