You can make use of an adaptable costs account (FSA) or health savings account (HSA) to spend for Invisalign. Some companies supply an FSA program that you can pay right into via pretax payroll reductions. An additional choice is an HSA, if you have actually a qualified high-deductible medical insurance plan. An HSA lets you establish money apart to pay for qualified medical, oral, as well as orthodontic expenses tax-free, but, unlike an FSA, the funds do not end after a year.

There's one more method to get tax obligation cost savings if you don't have an FSA or HSA. You can deduct medically essential oral as well as orthodontic expenses like Invisalign from your income tax return-- as long as they go beyond 7.5% of your adjusted gross income. So, conserve all your invoices.

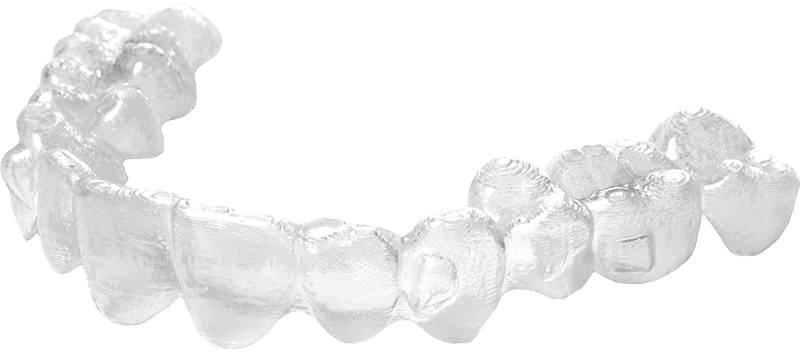

How does Invisalign work? A dental professional or orthodontist does a preliminary evaluation to see if you are a good prospect for Invisalign or if standard braces-- cable and brace appliances fixed to the teeth-- would certainly be better for you. Dental practitioners are experts in total tooth health. Orthodontists concentrate on tooth placement and also position. Prices will certainly depend on the degree of experience the supplier has with Invisalign.