does mortgage insurance cover death of spouse

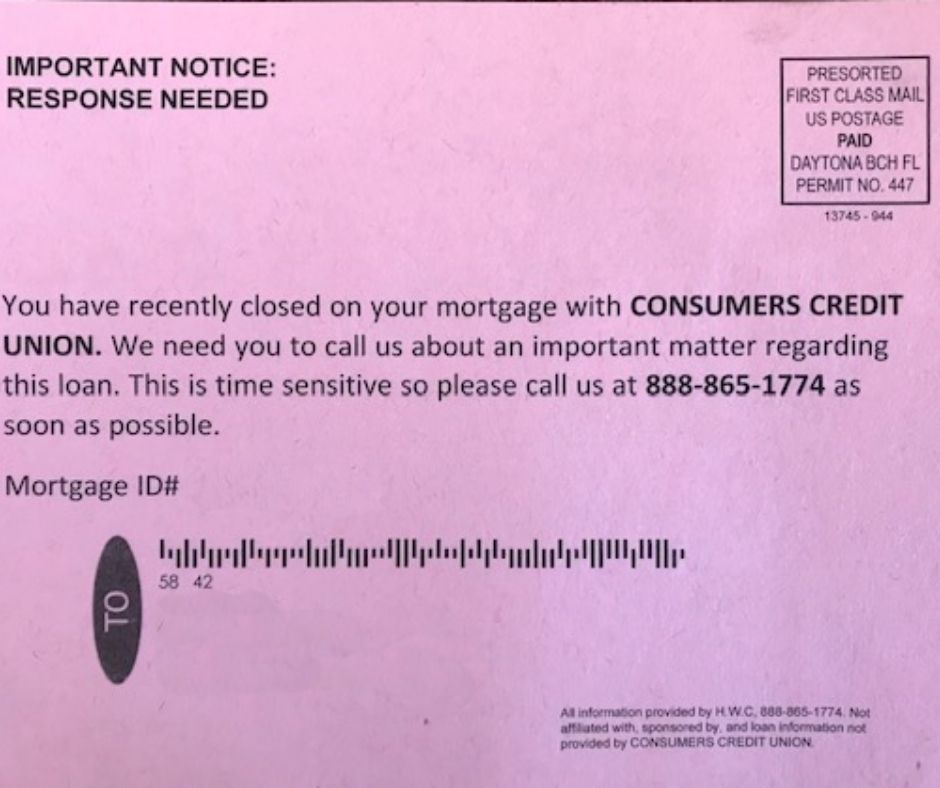

When you buy a house (or refinance), you get a lot of junk mail.

Most deals you receive via mail will have a postage-paid reply card included. Life agents know they'll receive a response percentage of between 2% and 3 percent. The next step would be to contact the person you want to speak with and set an appointment. Be careful. Most mortgage life professionals are trained to sell you a mortgage in one go. It's known as"the "one-call closure." Prepare yourself for a captivating presentation. Make sure you leave the estimate with you. It is essential to review the two options. Explain to them that this is a significant decision, and you'll have time to research and compare different companies.

Mortgage life insurance is a policy designed to pay off your mortgage in the event of your death or disability. Commonly, the policy has a decreasing benefit (face) amount that decreases proportionately to the decreasing balance of your mortgage. You, as the policyholder, name a spouse or someone else as the beneficiary so that they can pay off the mortgage in one lump sum. Alternatively, your beneficiary can keep the death benefit and continue making monthly mortgage payments.

does life insurance pay off mortgageDoes this sound like a great idea, or is it a hoax?

Several insurance firms will be in the pile of people telling you that you must safeguard your mortgage by acquiring a "mortgage security insurance" policy. It's common for mortgage holder to aid their family in staying at home if they die suddenly.

When you buy a house (or refinance), you get a lot of junk mail.

If you purchase a home (or refinance), you receive lots of unwanted mail.

There will be a lot of letters when you purchase an apartment as well as refinance your mortgage. These mortgage protection insurance appear to be official. They include the name of the lender as well as the mortgage amount. Life insurance agencies and companies have access to this public, accessible information and then send letters or postcards. If you notice the name of your mortgage company upon the notice, this could appear legitimate. Some believe that they're required to act.

Most deals you receive via mail come with a postage-paid return card. Life agents know they'll get a 2% and a three % response rate. The next step would be to contact the person you want to speak with and set an appointment. Be careful. Most mortgage life professionals are trained to sell you a mortgage in one go. It's known as"the "one-call closure." Prepare yourself for a captivating presentation. Make sure you leave the quotation with you. It is essential to review the quotes with other alternatives. Explain to them that this is a significant choice and you'll need the time to look around and think about other businesses.

Mortgage Life Insurance is just a cleverly packaged way to offer life insurance. Some would say it is a gimmicky approach, and in many cases, they are right. However, as stated earlier, many agents use this marketing strategy to target new homeowners. They recognize the potential need for additional life insurance protection.

Alongside making you aware of the need for life insurance, Mortgage Policies on life can also be an excellent deal for specific individuals. Check out the following article to determine whether you're among those who think this product is suitable.

Once you pay off your mortgage, you will no longer have a lender requiring you to have homeowners insurance. While you aren't federally required to have it, keeping your coverage is essential since it protects you financially if your home incurs significant damage or someone is injured on your property.

A mortgage protection life insurance policy is a term life policy explicitly designed to repay mortgage debts and associated costs in the event of the borrower's death. These policies differ from traditional life insurance policies. With a conventional policy, the death benefit is paid out when the borrower dies.

Is mortgage protection insurance tax deductible?

No. Typically, mortgage protection life insurance premiums are not tax deductible.