what is the best mortgage protection insurance

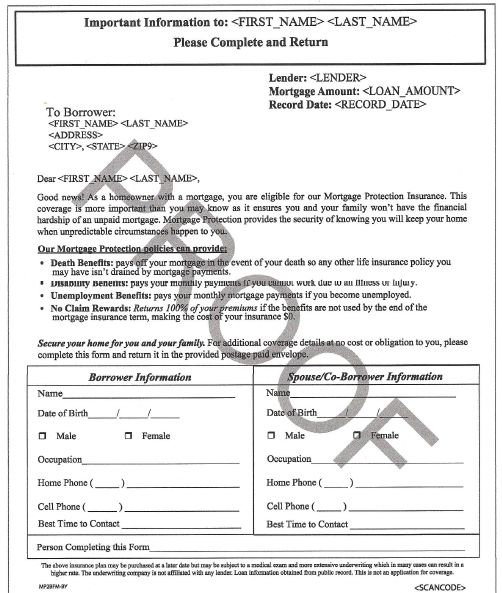

If you recently refinanced or bought your first home, you can expect to receive multiple offers from companies that sell mortgage protection insurance. Some of these offers may be frauds.

A "Return of Premium" (ROP) rider refunds the premiums you pay (excluding any claims) at the end of the term (usually 20 or 30 years). Reading the fine print on the ROP rider is important because details can vary widely.