can you buy mortgage insurance

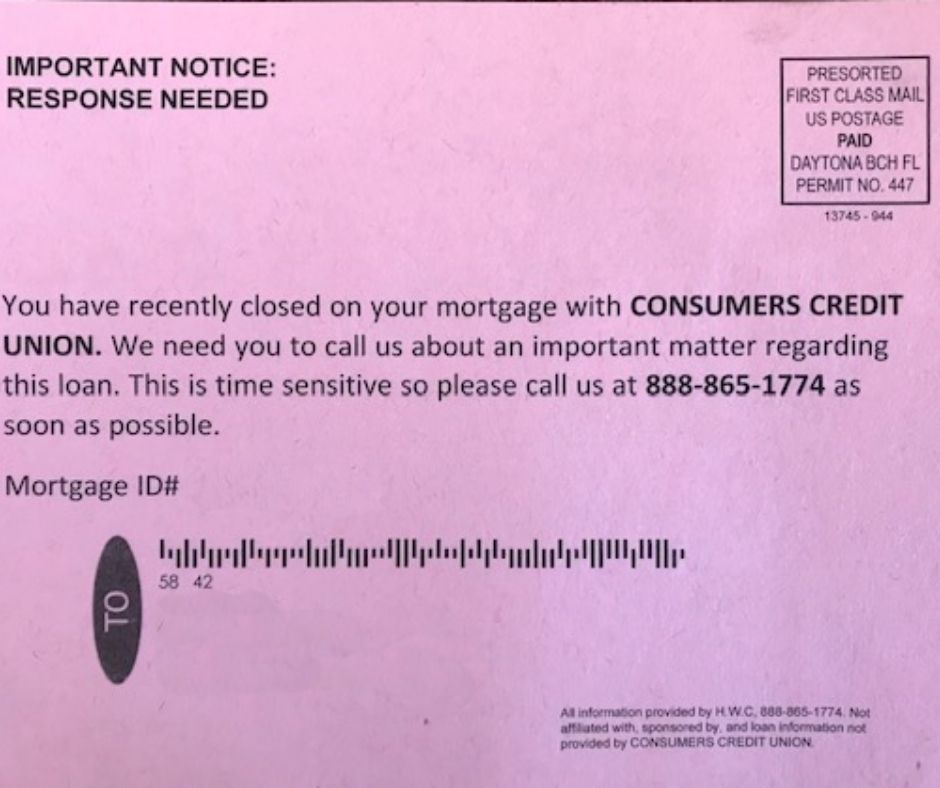

There will be a lot of letters when you purchase an apartment as well as refinance your mortgage. These mortgage protection insurance appear to be official. They include the name of the lender as well as the mortgage amount. Life insurance agencies and companies have access to this public, accessible information and then send letters or postcards. If you notice the name of your mortgage company upon the notice, this could appear legitimate. Some believe that they're required to act.

is mortgage life and disability insurance worth it