how much does mortgage protection insurance cost

If you have recently bought an apartment or refinanced your mortgage, you'll likely get numerous solicitations for "Mortgage Life Insurance" and "Mortgage Life Insurance." In this post, we'll review the advantages and disadvantages of Mortgage Protection Insurance. Is it possible to decide if Mortgage Protection Life Insurance is a fraud or an intelligent choice?

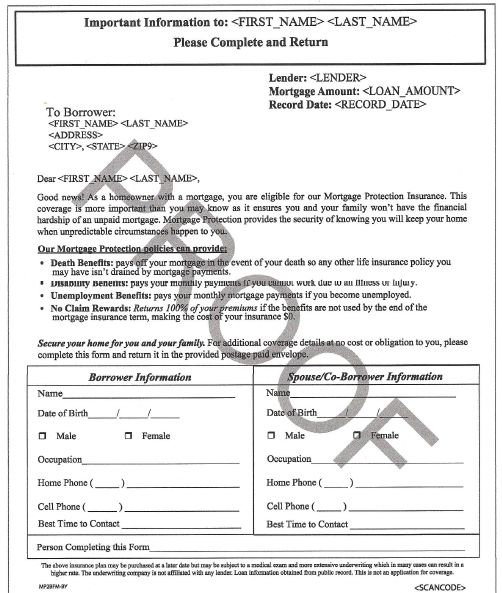

It's essential to recognize the warning signs of insurance fraud involving mortgages. It's equally important to be aware that most offers are genuine. If you're interested in this kind of insurance, follow the tips listed below when filling out an interest form or make a call to ensure the company is authentic and trustworthy.